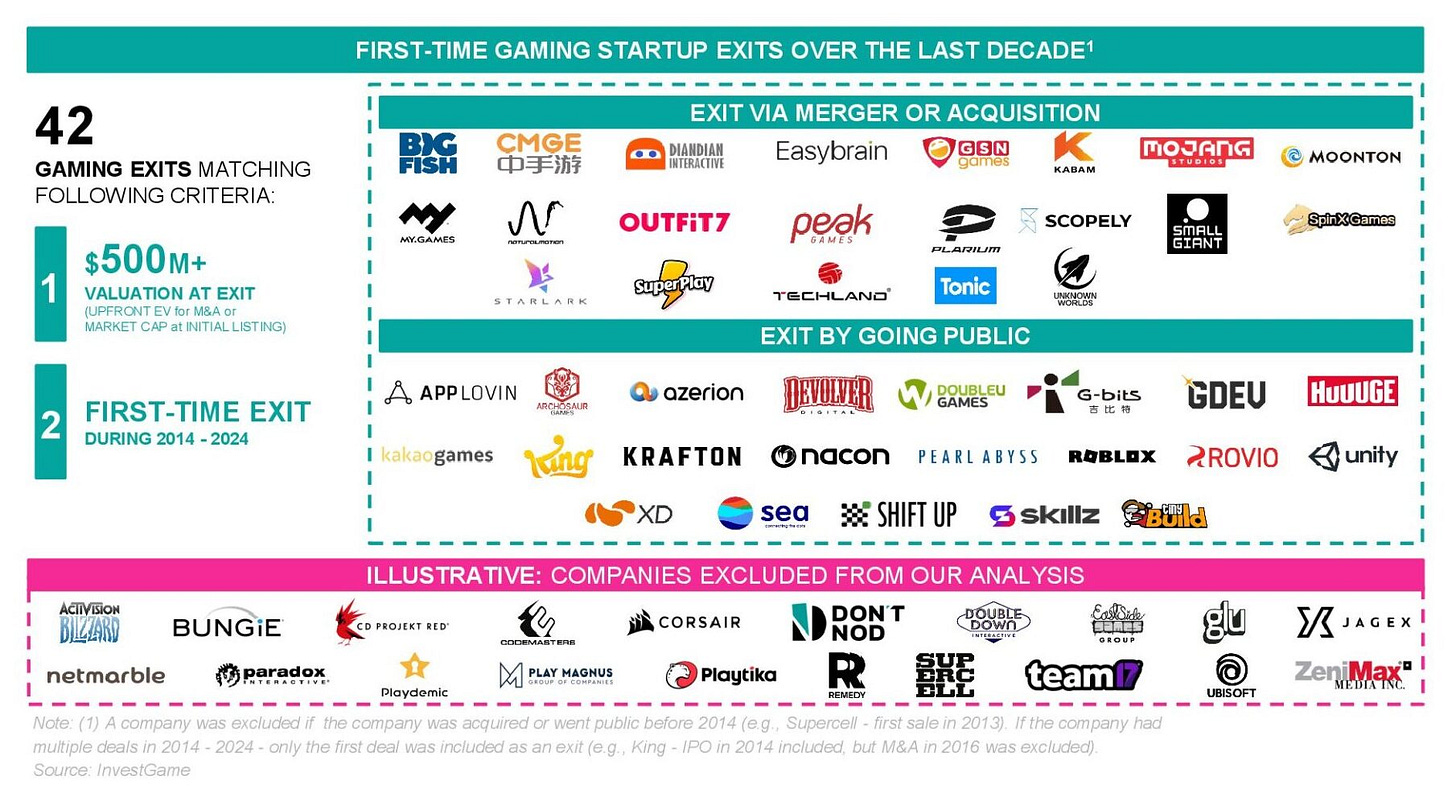

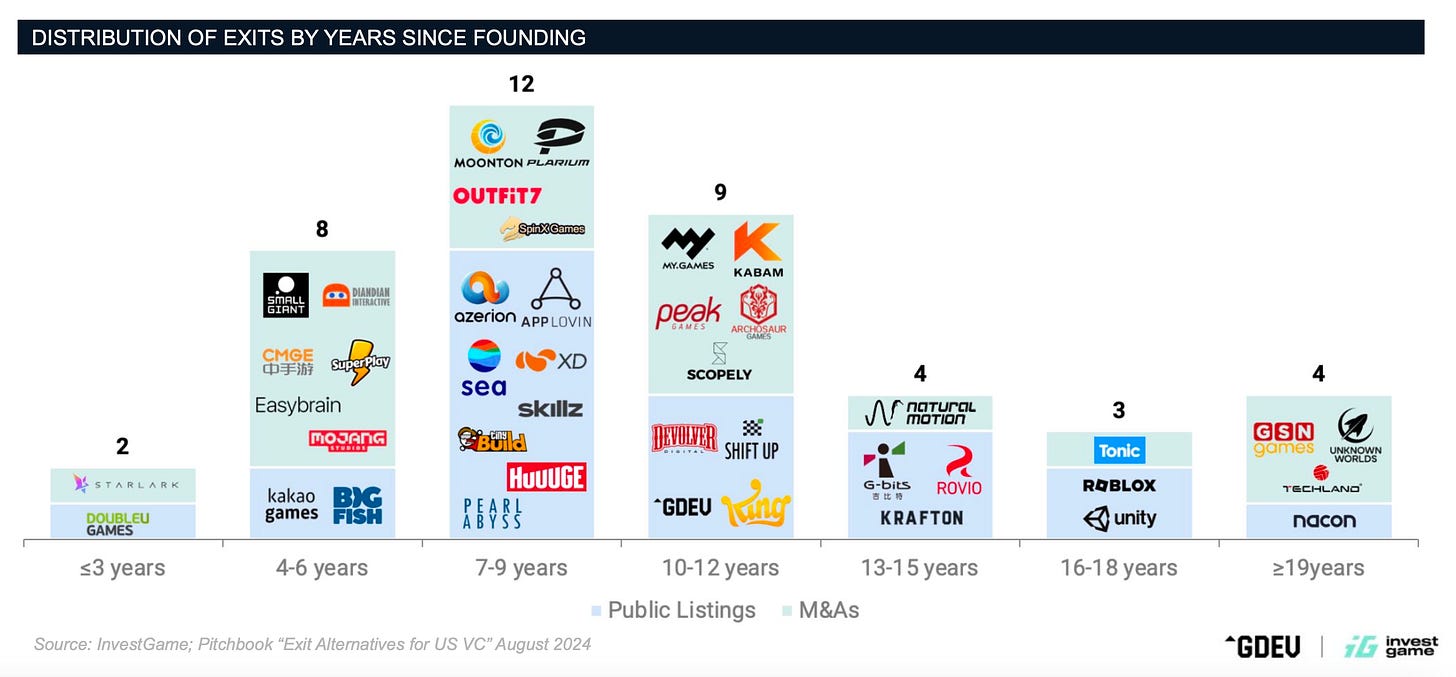

Major exits in the Gaming Industry over the last 10 years

The InvestGame team defines “major” exits as those worth $500 million and above. Data from the last ten years is taken into account. Only companies for which this deal is their first are included (which is why Jagex or Activision Blizzard, for example, are not on the list).

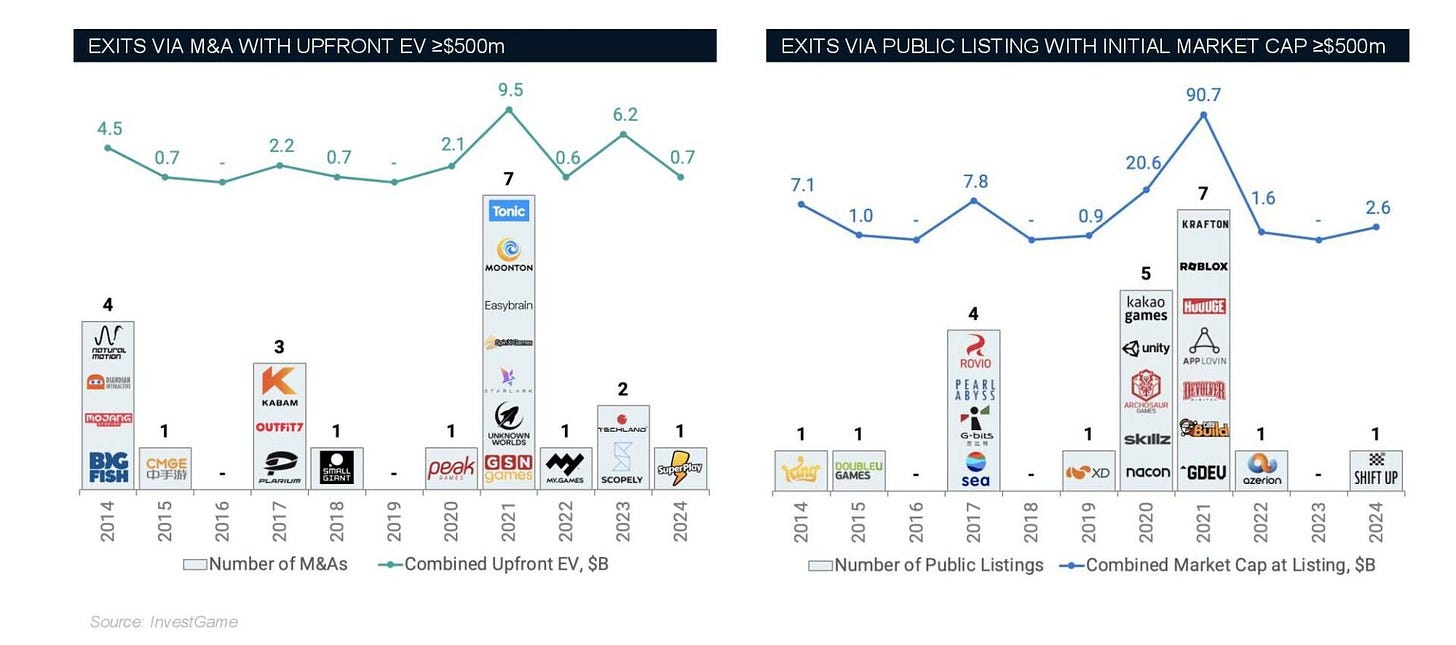

-

4 out of the 5 largest M&A deals in the past 10 years involved mobile phone companies. Mojang Studios stands out, as at the time of the Microsoft deal, most of its revenue came from PC and consoles. Two companies (Mojang Studios and SpinX Games) were created without outside investors.

-

The leading companies in valuation at the time of public offering are companies operating in the mobile phone market. They all generated most of their revenue from mobile devices at the time of listing (including Crafton). It is also worth noting that venture capital funds have funded all the companies on the list.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. You can access a curated list of articles and an archive of gaming reports I’ve been collecting since 2020.

-

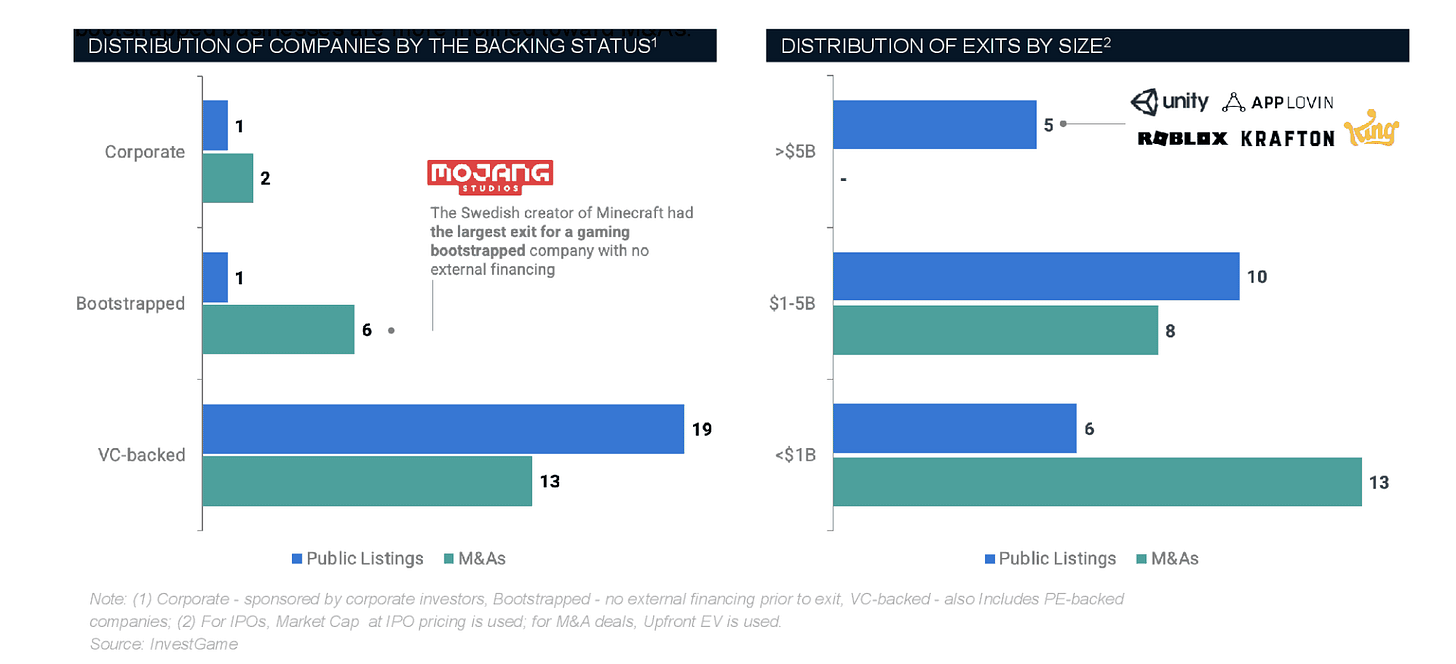

Companies participating in venture capital funds account for 75% of all large deals (valued over $500 million). 60% of companies funded by venture capital have gone the IPO route.

-

Of the companies founded with their own money, only 1 out of 7 has gone public – GDEV. All others were bought by larger players. Interestingly, out of the 7 companies, 5 were worth more than $1 billion at the time of the deal.

-

When looking at companies funded by corporate money, 3 companies entered the sample. One was purchased, and the other two went public.

❗️The goal of many corporate funds is to consolidate successful companies in their early stages. This may be why there are not many of them on the list. The assessment simply does not have time to “grow”.

-

Only companies that have gone public have valuations over $5 billion. M&A deals dominate the category of deals worth up to $1 billion.

-

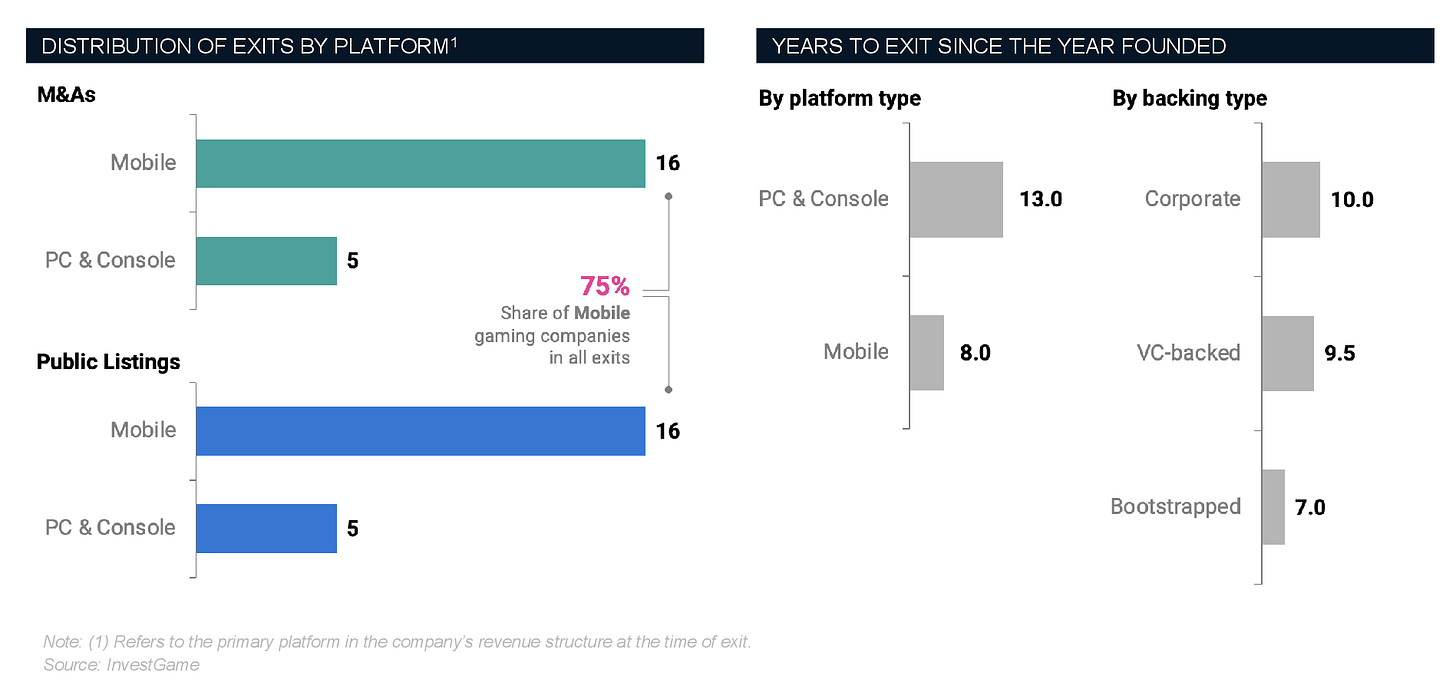

Mobile game companies are exiting, on average, 40% faster than PC/console studios.

-

Statistically, companies that have raised corporate funds take longer to exit (10 years). It takes 9.5 years for companies to obtain venture capital funding. The fastest companies to reach the point of sale or going public are companies that do not have external financing – it takes an average of 7 years.